le soin

par les actes

et par les droits

Depuis 1980, Médecins du Monde intervient de manière indépendante en France et à l'international pour garantir un accès universel et durable aux soins.

Témoigner pour dénoncer, informer pour engager

Comment Soutenir Médecins du Monde

Faire un don

Soutenez nos actions sur le terrain en faisant un don. Chaque geste compte.

Legs & donations

Faites durer votre engagement

en préparant la transmission de vos biens

Agir auprès

de ceux dont

la santé est

en danger

Agir ou donner pour que la santé soit enfin universelle

Nous sommes

ici et là-bas

Asie

Les conditions de vie et de travail, les épidémies et les mutations sociales en Asie sont à l’origine de profondes problématiques de santé publique. Les persécutions politiques et religieuses, les guerres et la pauvreté provoquent aussi d’importants mouvements migratoires à travers le continent asiatique.

Amérique

Face à ces situations d’urgence et de crises humanitaires en Amérique du sud et en Amérique centrale, les besoins en termes de santé sont importants, les infrastructures médicales et les personnels soignants font parfois défaut tandis que les dommages causés par les violences restent une barrière majeure à l’accès aux soins des plus vulnérables.

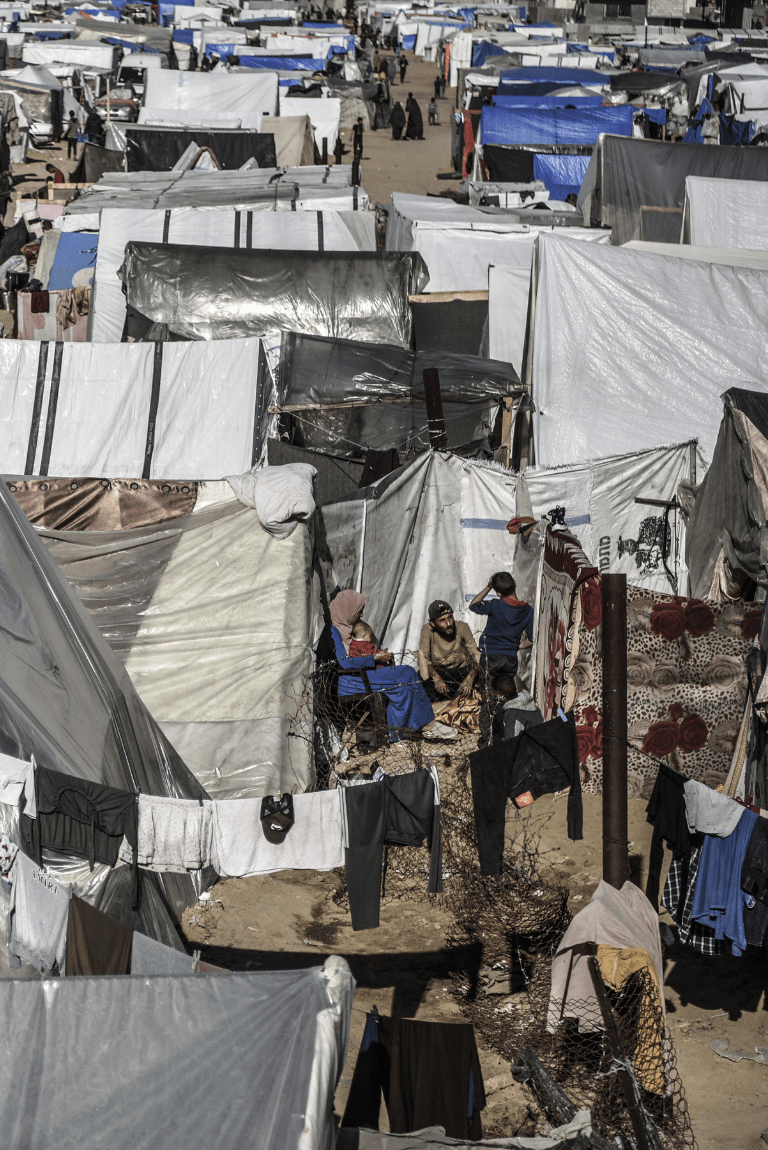

Moyen-Orient

Au Moyen-Orient, plusieurs pays comme l’Irak, la Syrie ou le Yémen sont en proie aux guerres civiles. De nombreuses populations sont obligées de se réfugier dans les régions voisines pour fuir les violences et l’insécurité.

Europe

Pour répondre à ces besoins médicaux, notre association déploie une aide humanitaire en Europe afin de contribuer à un accès à la santé effectif, juste et universel.

Afrique

La violence des conflits armés et l'instabilité qu'elle nourrit dans plusieurs pays d'Afrique contribuent à profondément déstabiliser des systèmes de santé déjà fragiles mais également peu accessibles.